Charles Wells- better known as “the man who broke the bank at Monte Carlo” – was a complex character. He broke the law many times yet he clearly had a…

Robin Quinn

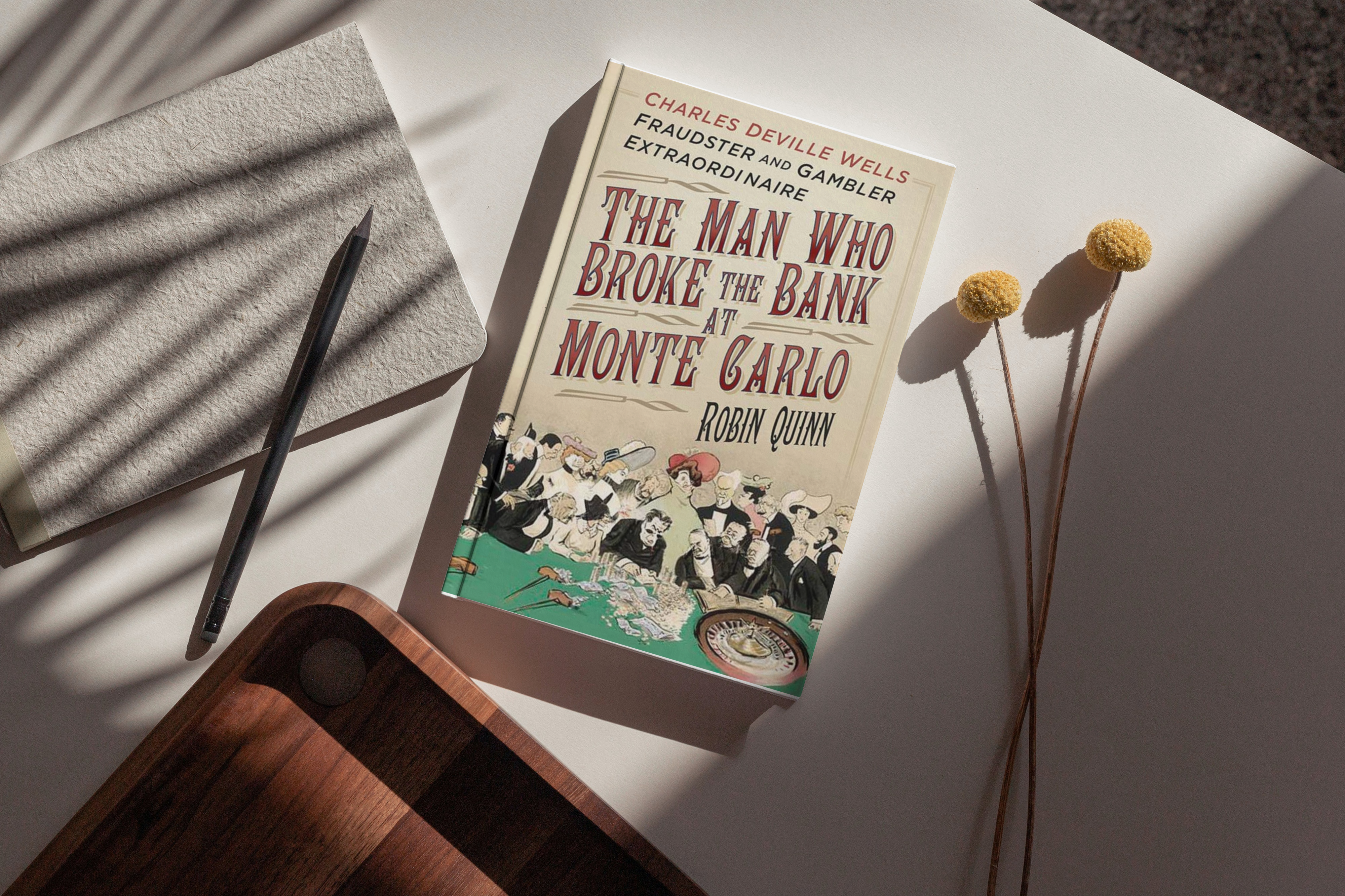

Author of the "The Man Who Broke the Bank at Monte Carlo" and "Hitler's Last Army".

He has produced numerous documentaries for BBC Radio 2 and is the Executive Producer for media production company, Play It By Ear.

Books

The incredible true story of Charles Deville Wells, gambler and fraudster extraordinaire.

”Brilliant - a terrific read.

Michael Aspel, OBETelevision host

”The best book I've read all year.

Nigel Jones, EditorDevonshire Magazine

”Excellent biography.

Helen BrownFinancial Times

Available in hardback and paperback from Amazon, Waterstones and all other good book sellers. Also available as an audiobook from Audible.

Blog

Journalist Helen Brown, writing in the Financial Times, reveals the extraordinary history behind the song ‘The Man who Broke the Bank at Monte Carlo’. It was written in 1891, soon…

This time it’s not the British royals who come under scrutiny in connection with the Monte Carlo Casino. Instead it’s the Monaco royal family. In 1889 – just a couple…

Queen Victoria often visited the French Riviera but – as described in my book, ‘The Man who Broke the Bank at Monte Carlo‘ – she considered that the Casino in…

In The Man who Broke the Bank at Monte Carlo I briefly mention (in a footnote) that our present monarch, King Charles III, is related – albeit distantly – to…

The Man who Broke the Bank at Monte Carlo – Charles De Ville Wells – perpetrated several frauds during his career. His biggest scam was to set up a phony…

In my most recent blog posts I noted that just before his first and most successful trip to Monte Carlo, Charles Wells placed a small-ad in The Times requesting a…

Charles Wells claimed on several occasions that he had developed a unique system for winning at Monte Carlo, though naturally he did not go into any great detail. He is…

In my book, The Man who broke the Bank at Monte Carlo there’s a mystery that has never been entirely solved. In late July the man who broke the bank,…

Charles Wells – the man who broke the bank at Monte Carlo – had several highly unusual friends. They included a Vicar who had once served a prison sentence for…